Datalex NDC - A New Era of Servicing and Selling

Realising the potential of NDC for a transformed future of travel retail is one of the fundamentals of our mission at Datalex. Enabling airlines to achieve much greater flexibility, consistency, and differentiation in how they retail across all channels and most importantly create new opportunities to drive additional revenues.

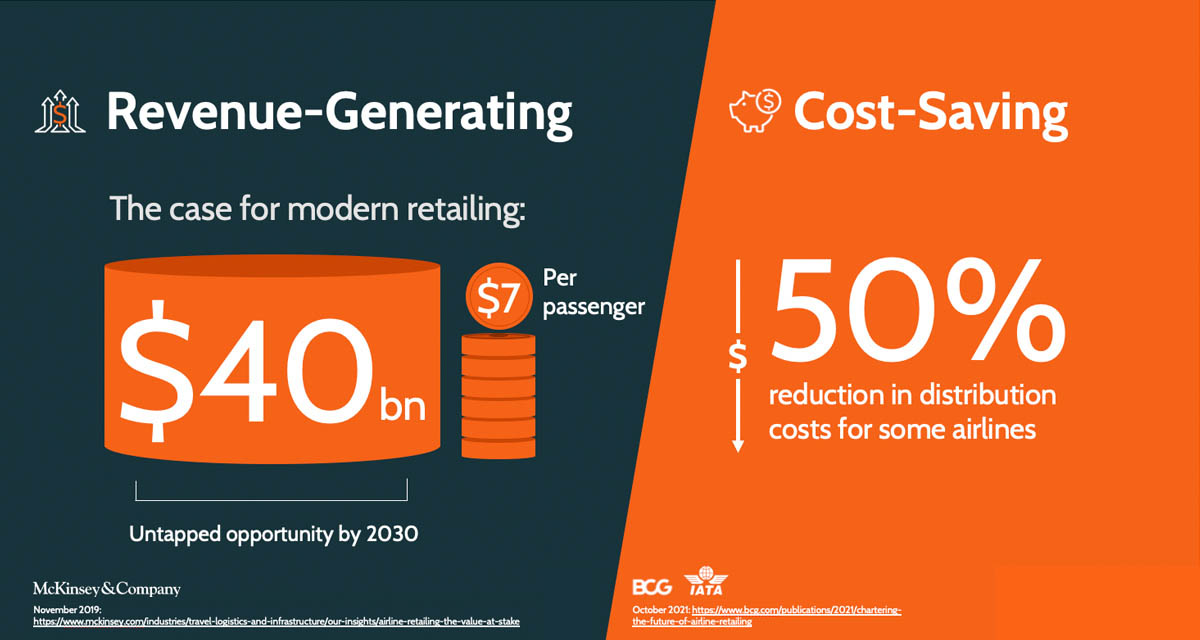

In a recent report, McKinsey & Co. estimated airline retailing to generate approximately USD$ 40 billion in additional annual value by 2030. This represents an extra 4% of the total industry revenue or $7 per passenger at the end of the decade. The potential of NDC to enhance airline retailing is the one of the most important opportunity airlines have in the ongoing recovery of travel, and represents the path to truly modern airline retailing. It’s clear that airlines that don’t integrate NDC into their strategy are leaving opportunities on the table.

In a Datalex co-hosted webinar with IATA Airlines. today, we delved into this important topic of NDC and its role as a vital enabler in the industry-wide ambition to realise true modern airline retailing. Let’s take a look at some of the insights from that webinar and how Datalex is differentiating, and leading the market with NDC for better retailing for all – the airline, the agency and the end-traveller.

THE AIRLINE / AGNECY RELATIONSHIP REIMAGINED

For too many years, travel agents have been selling airline products without full knowledge of airline offers and using sub-par tools to do so. For this reason, these relationships were not nurtured, let alone optimised. NDC however is transforming the airline / agency dynamic and presents one of the biggest opportunities for the airline industry in the journey to modern airline retail. By leveraging advanced NDC technology, airlines and agencies can accelerate a distribution channel that has been underserviced and under-optimised for years. Airlines can gain greater control over the traditionally passive relationship with agents, while these agents can access richer content from the airline that was not accessible previously. Maria Gray, Senior Product Manager for NDC at Datalex noted that 'it is a power struggle - it's a synergistic relationship enabled by technology.'

The advantage to the sellers and travel agents overall from NDC is that modern retailing is now available in the agency world and are available in the following ways:

- They now have a closer relationship to collaborate effectively on selling

- Targeted incentives are also a much better way for agencies to demonstrate performance

- Agents can also get preferential access to content with richer product catalogues and ancillary offers.

NDC AND MODERN RETAILING TRENDS

- Ramp up in NDC investment for aligned retailing across all channels drives growth- The tide is turning for NDC investment within airlines as airlines seek out investment to accelerate growth in the NDC channel. Airlines are emerging from exclusive cost-saving exercises and NDC is presenting a real opportunity to grow revenues from a vastly improved agency / airline relationship and indirect traffic from new markets.

- The Need for Speed - Legacy systems not built for flexibility - Airlines operate in an ever-changing travel landscape with customers that have higher retail and service expectations than ever before. Moreover, the onslaught of cancellations and travel disruption this past year highlighted the need for much greater servicing needs and in particular real-time servicing and superior self-service capability in times of disruption. NDC is vital to enable this across the indirect channel.

- Move towards ‘distribution freedom’ – There is an increasing trend towards a distribution freedom strategy with several airlines making the leap by incentivising and steering content towards the NDC channel. This is benefitting innovative, ‘first-mover’ agents who are using the preferential content to their advantage and driving greater bookings in turn for the airlines. A win-win for the airline and the travel agent.

- Airline assembly of optimal offers - Agencies receiving the best offers assembled by the airlines, rather than the agencies trying to package an offer together, means that agencies can work more efficiently to deliver better offers to travellers for a higher conversion. The ability to intelligently offer the right products and corresponding prices across all channels represents a significant and important shift in customer engagement and conversion.

- Differentiated content - Communicating via differentiation - The ability to leverage NDC to deliver differentiated content where possible is a key opportunity. Essentially airlines can present unique differentiated content through their offers leveraging NDC, as agents are empowered to choose the offer with the richest content and most optimal price.

- Next Generation Order Servicing – Customer service and the ability to self-serve is key to a good travel experience. This is something that can be improved leveraging NDC and through our 21.3 NDC schema combined with our market-leading OMS (Order Management System), we deliver consistent servicing across direct and indirect channels.

A WIN-WIN FOR ALL – REVENUE-GENERATING AND COST-SAVING

A strong NDC strategy will ensure an airline not only benefits from distribution cost savings, but also from revenue generating opportunities.

Revenue-generating - Through differentiation of offers airlines can compete for greater wallet share and can eke out competitive differentiation. Airlines can generate greater revenue through dynamically determined and optimised offers all enhanced by continuous pricing. According to BCG & IATA, there is $7 for the taking per passenger by 2030.* Datalex’s NDC is underpinned by a unified merchandising platform which helps airlines to realise these revenue generating opportunities.

Cost-saving - Through next generation order servicing airlines can save costs through a reduction in direct customer contact as they are better placed to self-serve. BCG and IATA have found that early-movers in the distribution-cost saving space have seen as much as a 50% cost reduction.**Airlines can now have complete order control to manage the order journey, with zero duplicate costs incurred. There is also the benefit of ‘distribution freedom’ and the negotiation power that comes with that. Datalex NDC capabilities reflect these needs for cost savings by putting the airline in control of the order.

* McKinsey & Company November 2019: https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/airline-retailing-the-value-at-stake

** October 2021: https://www.bcg.com/publications/2022/airline-retail-revolution-demands-reshaping-airline-organization

Related Insights

Explore more about the trends and innovations, and keep up with the latest insights and developments in airline retail.